Kenapa Telkom University

- Salah Satu PT Terbaik di Indonesia

- #450 Perguruan Tinggi Terbaik se-Asia

- 60 Program studi berbasis IT

Fakta Telkom University

Dosen

0

Mahasiswa

0

Alumni

0

Hektar Kampus

0

Apresiasi

Telkom University “ Creating The Future”

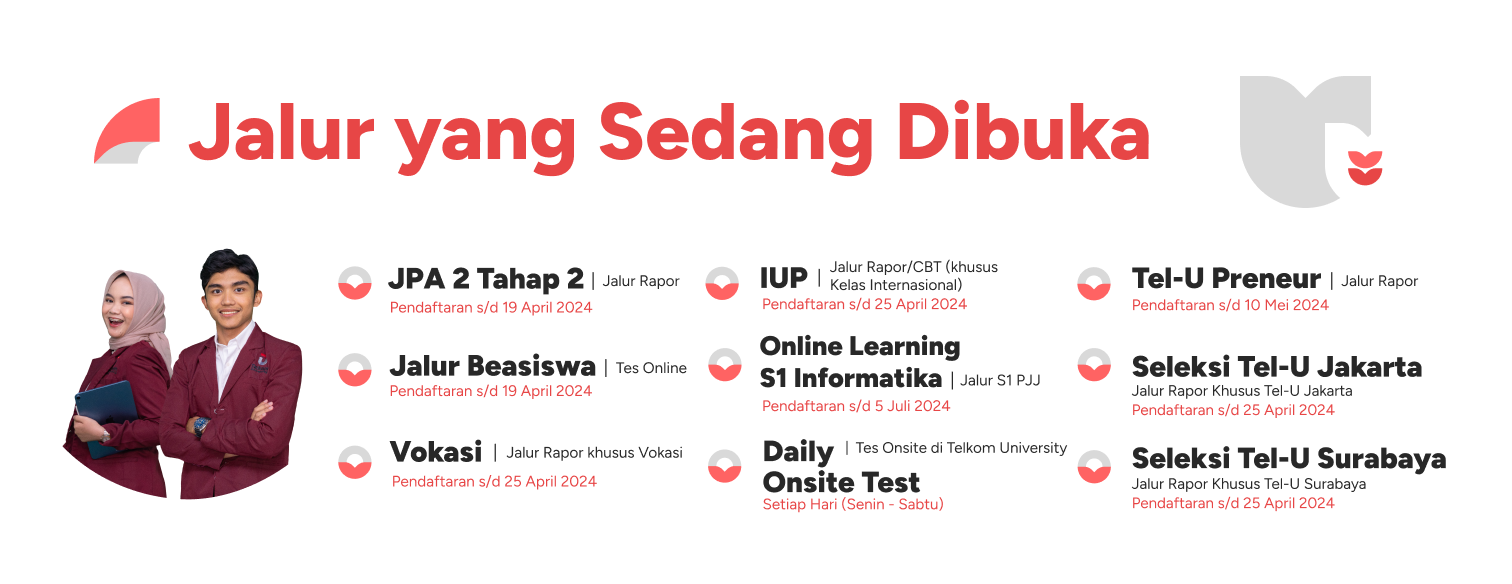

Bagaimana Menjadi Telutizen

Kembangkan minat dan bakat melalui keilmuan terbaru. Kini saatnya industri mencarimu

Apa Kata Mereka

Lebih dari 70 ribu alumni Telkom University memiliki pengalaman perkuliahan menarik yang membantu mereka memberikan kontribusi untuk Indonesia

Ghuniyu Fattah Rozaq

Co-Founder and CTO StafBook

Sistem Informasi

Fakultas Rekayasa Industri

Fakultas Rekayasa Industri

Gagallah lebih cepat. Habiskan jatah gagalmu. Banyak yang bisa kamu explore. Di Telkom University sudah ada wadah untuk kalian explore lebih banyak.

Zulham Siregar

Fashion Photographer

MBTI

Fakultas Ekonomi dan Bisnis

Fakultas Ekonomi dan Bisnis

Telkom itu selain kampusnya bagus, akreditasinya juga bagus. Banyak banget informasi yang aku dapatkan dan ternyata diperlukan pada saat di dunia kerja. Sebagai Fashion Photographer yang bisa diambil adalah bagaimana cara mengatur bisnis fotografi dan diaplikasikan di dunia nyata.

Tubagus Rizky Dharmawan

ICT Data Communication - PT. PGN

Teknik Telekomunikasi (Digital Connectivity)

Fakultas Ilmu Terapan

Fakultas Ilmu Terapan

Telkom University memberikan wawasan dan kesempatan untuk bersaing secara global. Pengembangan skill dan pengajaran yang diberikan sangat relevan dengan dunia kerja ataupun pendidikan selanjutnya. Selain itu, alumni Telkom University tersebar dibanyak sektor, sehingga membuka relasi untuk berkontribusi dan mengembangkan kemampuan terbaik.

Nera Leiya Maisury

Founder & Creative Director at Kern Space

Desain Interior

Fakultas Industri Kreatif

Fakultas Industri Kreatif

Setiap momen sebagai mahasiswa Desain Interior itu precious. Bisa mengikuti berbagai kegiatan di Telkom University memberikan pengalaman baru yang sangat berharga. Itulah yang membentuk Nera sedemikian rupa hari ini.

Andika Julianda

Country Sales Manager Q-Free ASA

Administrasi Bisnis

Fakultas Komunikasi dan Bisnis

Fakultas Komunikasi dan Bisnis

Masuk ke sebuah entitas yang baru memang butuh penyesuaian yang lama namun tidak untuk Telkom University, asrama satu tahun momen yang selalu dikenang, kenal teman teman dengan beragam latar belakang, suku,budaya membuat saya merasa inilah momen yang paling berharga.

Rhienta Aprisella

Content Operations Associate Ruangguru

MBTI

Fakultas Ekonomi dan Bisnis

Fakultas Ekonomi dan Bisnis

Kami yang berasal dari berbagai penjuru Indonesia dipertemukan di Telkom University dengan tujuan yang sama, yaitu untuk menuntut ilmu sedalam-dalamnya.

Anastasya Lutmila

Product Manager Commerce at detikcom

Smart Science & Technology

Fakultas Teknik Elektro

Fakultas Teknik Elektro

Di Telkom University mahasiswa didukung banget buat aktif dan explore banyak hal. Mulai dari pembelajaran teori, praktikum, organisasi, sampai pengalaman kerja semua bisa aku dapatkan di sini.

Jika kamu sedang mencari prospek kerja yang menjanjikan, maka jurusan manajemen adalah pilihan yang tepat. Menilik jurusan manajemen yang paling cocok denganmu!

SMB Telkom Hadir di Media Sosial

Follow kami agar tidak ketinggalan informasi ter-update setiap hari

Universitas Swasta #1 Terbaik di Indonesia | Toward Research and Entrepreneurial University